Forex Withdrawal Problems: Ultimate Guide for Traders

BY Chris Andreou

|January 7, 2026Forex withdrawal problems and delays can be stressful for traders, especially when you need your money back quickly. In practice, most issues with reputable brokers trace back to compliance checks, payment network times, or simple data errors. Understanding how money moves through banks and payment networks will help alleviate your anxieties and frustrations.

This guide explains how withdrawals normally work and the most common causes of forex withdrawal problems. You’ll also learn how to set realistic expectations and prevent issues before they start.

Let’s get started.

How forex withdrawals normally work

You have verified your account and submitted a withdrawal request through the client portal.

Step 1: We process your request

Once you submit a withdrawal request, we typically review and process it within a few hours or up to one business day during busy periods. When processing is completed, the withdrawal is sent through the relevant banking or payment network. Withdrawals are always sent back to the source of the original deposit as a refund of the initial deposit and a bank wire transfer, or any other available methods for any profits.

Step 2: Your bank or payment provider delivers the funds

After we process your withdrawal request, the time it takes to receive your funds depends on the payment method used and the banking system. Even when a method is described as instant, additional checks by banks or payment providers can cause delays. This is normal in financial services, you can expect your funds to be delivered within one business day for card and e-wallets and between one and five business days for bank transfers.

Compliance rules that influence broker withdrawal delays

- KYC & AML: Brokers must verify your identity and address, and sometimes request proof of the source of funds before a withdrawal can be made. Ensure you complete the verification of your trading account ahead of time.

- Return funds to source: Card and wallet withdrawals go back to the original funding method up to the deposited amount. Any profits have to be sent by bank wire, because refunding more than the total amount is not possible. Brokers withdrawal delays can occur if they need additional bank details.

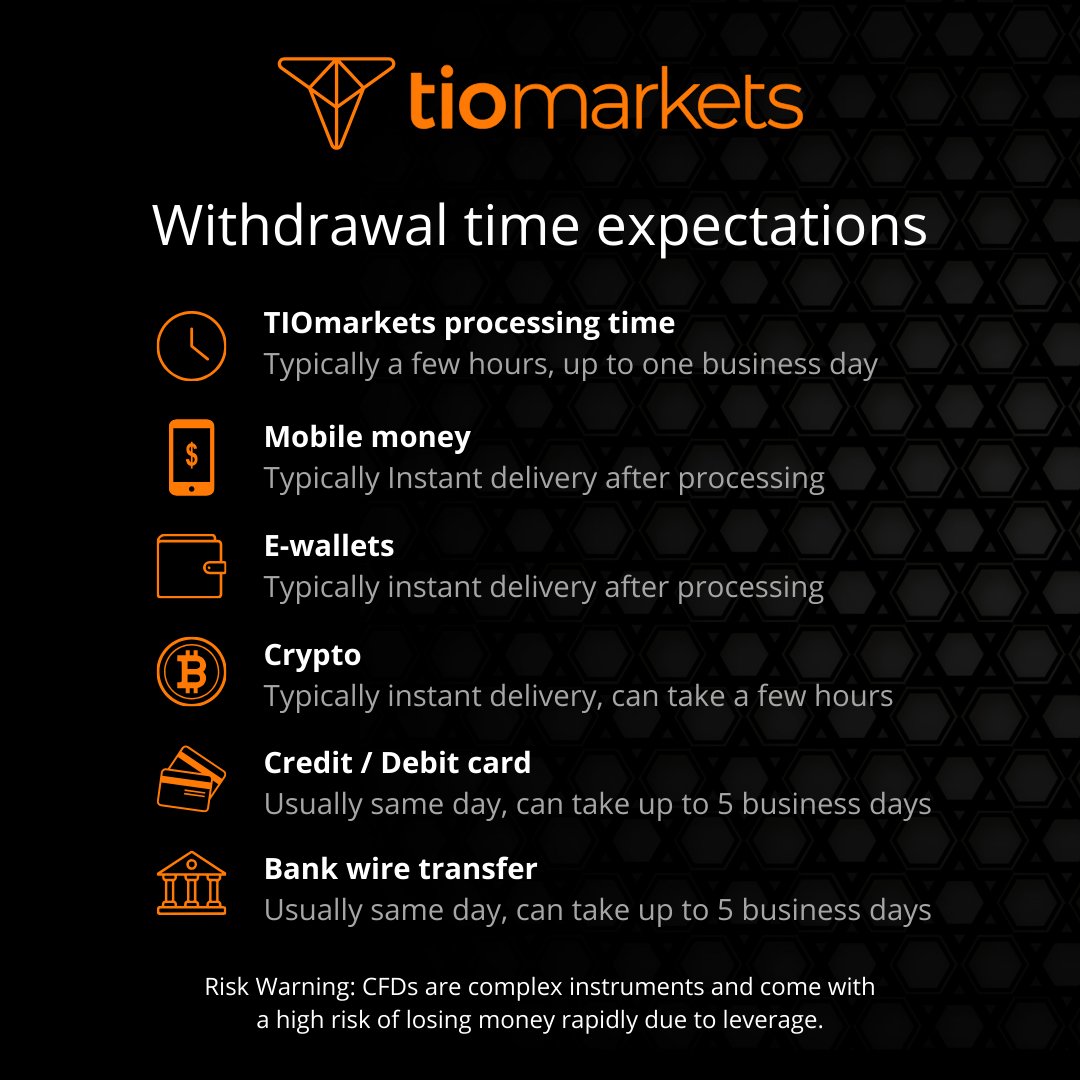

Withdrawal time expectations

- TIOmarkets processing: Typically a few hours, up to 1 business day.

- Mobile money: Instant after TIOmarkets processing.

- E-wallets (Skrill / Netteller): Instant after TIOmarkets processing.

- Cryptocurrency (Crypto-to-fiat): Usually instant, up to a few hours after TIOmarkets processing.

- Credit/debit cards: Usually same day, can take up to 5 working days after TIOmarkets processing.

- Bank wires: Usually same day, can take up to 5 working days after TIOmarkets processing.

Common causes of forex withdrawal problems (and fixes)

Most forex withdrawal problems come from incomplete verification, mismatched payment methods, open trades and margin requirements, or payment network rails. Check your ID and address documents, close or hedge positions to free margin, confirm banking details, and ask your broker for a payment tracking reference.

This is how to minimize withdrawal problems when trading.

Account verification

Submitting all required verification documents in advance to any withdrawal prevents withdrawal delays. Don't wait until you need an urgent withdrawal to begin the verification process.

Verification best practices include:

- Submit high quality document images that clearly show all details

- Ensure all information is clearly visible and matches your registration details

- Provide documents in accepted formats

- Include all required documents in your initial submission to avoid back and forth

Maintaining current documentation prevents future re-verification requirements. Update your verification documents before they expire to ensure continuous withdrawal access without interruption.

Withdrawal request timing

Strategic withdrawal timing helps avoid processing delays and reduces any fee impact on your funds. Consider multiple factors when planning your withdrawal schedule for optimal results.

Key timing considerations for efficient withdrawals:

- Avoid peak processing periods like month end when volumes are highest

- Submit requests early in the business week to prevent weekend delays

- Consider bank holidays in both your jurisdiction and the broker's location

- Consider time zone differences for international transfers

If you plan ahead for your financial needs while respecting broker processing and payment method delivery times, you will receive your withdrawals quickly and smoothly.

Unrealistic delivery time expectations

Many traders underestimate the total time required for withdrawals. Withdrawal speed depends on two things, broker processing time and the delivery time by the payment provider or your bank. Most frustrations happen when these two things are mixed together, or expecting instant access to funds without accounting for these two schedules.

Common timing misconceptions:

- Assuming broker approval happens instantly like internal transfers

- Not accounting for payment method delivery timeframes

- Expecting weekend or holiday processing from traditional banking systems

- Overlooking intermediary banking delays for international transfers

Plan withdrawal requests with realistic timeframes that account for both the broker’s processing time and the payment network’s delivery time. Submit requests early when you have upcoming financial obligations. Track your withdrawal through both broker status updates and payment method confirmation notifications. Contact support for status updates only after a reasonable amount of time has passed.

Understanding these separate processing stages prevents frustration and helps you plan your trading capital management more effectively.

Credit/debit card refund windows

Credit and debit card refund capabilities have strict time limitations that directly impact your withdrawal options. Most payment processors and banks only allow refunds to cards for a limited time after the original deposit, typically ranging from 90 to 180 days, depending on your card issuer and the broker's payment system.

- After expiration: All withdrawals must go to verified bank accounts via wire transfer

- Card replacement: New card numbers reset the refund window entirely

When you have multiple card deposits, withdrawals follow a strict chronological first-in-first-out order. Your oldest card deposit must be refunded before newer card deposits become eligible. This prevents you from choosing which specific deposit to refund and can cause confusion.

Example scenario:

- January deposit: $1,000 from card A

- March deposit: $2,000 from card B

- May withdrawal request: $1,500

The system automatically refunds $1,000 to card A first, then $500 to card B, regardless of which card you prefer to use. Once card refund windows expire, all withdrawals default to bank wire transfers, which typically take longer and may incur higher fees than card refunds.

Payment method verification mismatch

Some withdrawal delays occur when the bank account you're trying to withdraw to doesn't match your verified account. Brokers return funds to source an Anti-Money Laundering (AML) measure. In the case of credit/debit card and E-wallets, it's only possible to refund up to the total deposit amount. Any profits are sent to a bank account in your name.

Insufficient account balance after fees

Withdrawal failures can happen when traders don't account for any processing fees or currency conversions, for example, that reduce their available balance below the withdrawal amount requested.

Balance calculation factors to consider:

- Broker withdrawal fees deducted from your account

- Currency conversion spreads for foreign currency transfers

Check your real-time account balance including all pending charges before submitting withdrawal requests. Leave a small buffer amount in your account to cover any unexpected fees or market movements. Use your broker's fee calculator or contact support to understand all charges that will apply to your specific withdrawal method and amount.

Open positions

Open positions, pending orders, or unsettled trades can lock portions of your account balance, preventing withdrawals even when your total equity appears sufficient for the requested amount.

The only option is to close all open positions before attempting withdrawals.

Banking compliance restrictions

Your bank may reject incoming transfers from forex brokers due to their internal policies, insufficient account verification, or geographic restrictions on international transfers. Consider using alternative payment methods like e-wallets or crypto if your bank consistently blocks forex trading related transfers. It depends on your country and bank.

Bonus and promotion restrictions

Active bonuses or promotional credits can come with withdrawal conditions that many traders overlook. These restrictions can completely block withdrawals until specific trading requirements are met.

Common bonus related withdrawal blocks:

- Minimum trading volume requirements have not yet fulfilled

- Withdrawal restrictions during bonus credit periods

- Profit limitations while bonus funds remain active

- Required trading timeframes before bonus funds convert to withdrawable cash

Read all bonus terms and conditions before accepting promotional offers. TIOmarkets, does not create unfair terms and conditions related to bonuses or lock your money in because you have accepted a bonus.

If your withdrawal is taking longer than expected

Extended withdrawal delays beyond normal processing timeframes are typically caused by intermediary banking processes, payment network congestion, or verification holds rather than lost transactions. Most delayed withdrawals resolve automatically without intervention once underlying processing has been cleared. However, this is what you can do if your withdrawal is delayed.

First 24-48 hours after expected delivery

- Verify all account verification documents remain current and approved

- Check for any email notifications regarding processing holds

- Confirm your withdrawal request shows "processed" status in your client portal

- Review your bank account and payment method for any pending or rejected transactions

After initial grace period expires

- Contact your receiving bank to verify they haven't placed holds on incoming transfers

- Check with your payment processor (Neteller, Skrill, etc.) for any account restrictions

- Verify your account details match exactly what you provided to the broker

- Confirm there are no currency restrictions or compliance reviews delaying the transfer

When contacting customer support for assistance

- Provide your withdrawal request reference number and exact submission time

- Request payment confirmation documentation showing funds were sent

- Ask for correspondent bank details if using wire transfers for fund tracing

- Obtain payment tracking reference numbers or transaction IDs for payment network investigation

Most payment networks maintain detailed transaction logs that allow banks and payment providers to locate delayed transfers quickly when provided with proper documentation. Our customer support team can provide the specific reference information your financial institution needs to trace and expedite delayed incoming transfers.

Documentation you can request from your broker:

- Payment confirmation receipt with a transaction reference number

- Correspondent banking routing information for wire transfers

- Payment processor transaction ID for e-wallet transfers

Keep detailed records of all communication and reference numbers, as these expedite resolution when multiple parties are involved in locating delayed payments.

FAQ

Why can’t I withdraw from my forex broker?

The most common causes are incomplete KYC, mismatched funding and payout methods, insufficient free margin, or bank rejections. Fix those first and ask for a payment reference.

How long do forex withdrawals take?

It varies by method and jurisdiction. Cards can take several business days after approval, bank wires a few days, and wallets are often quicker. None are guaranteed due to external banking timelines.

Can a broker refuse a withdrawal?

It depends on the case, but generally they can not withhold your funds for a legitimate withdrawal request. Regulated and legitimate forex brokers can refuse and withhold withdrawals temporarily if compliance requires it. If you breach their T&Cs (for example, bonus abuse), they can withhold any profits made. They should give a reason in writing but the financial system is strict and forex brokers must comply with financial legislation and traders must comply with the terms of service..

Do bonuses block withdrawals?

Bonuses often carry minimum lot rules with most brokers. You should still be able to withdraw your own deposited funds unless the terms say otherwise, but bonus credits may be non‑withdrawable and be revoked. Always check the terms and conditions.

What if my broker says the funds were sent but my bank can’t find it?

Ask for a payment confirmation or a tracking number and provide them to your bank for tracing. Returned wires usually happen when beneficiary details are wrong.

Are fees normal on withdrawals?

Payment networks or bank fees are common but some brokers like TIOmarkets cover these charges when you deposit or withdraw the minimum.

Can I withdraw money to another person's account?;

No. Withdrawals must go to an account in your name for AML and anti‑fraud reasons.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Experienced independent trader

Related Posts